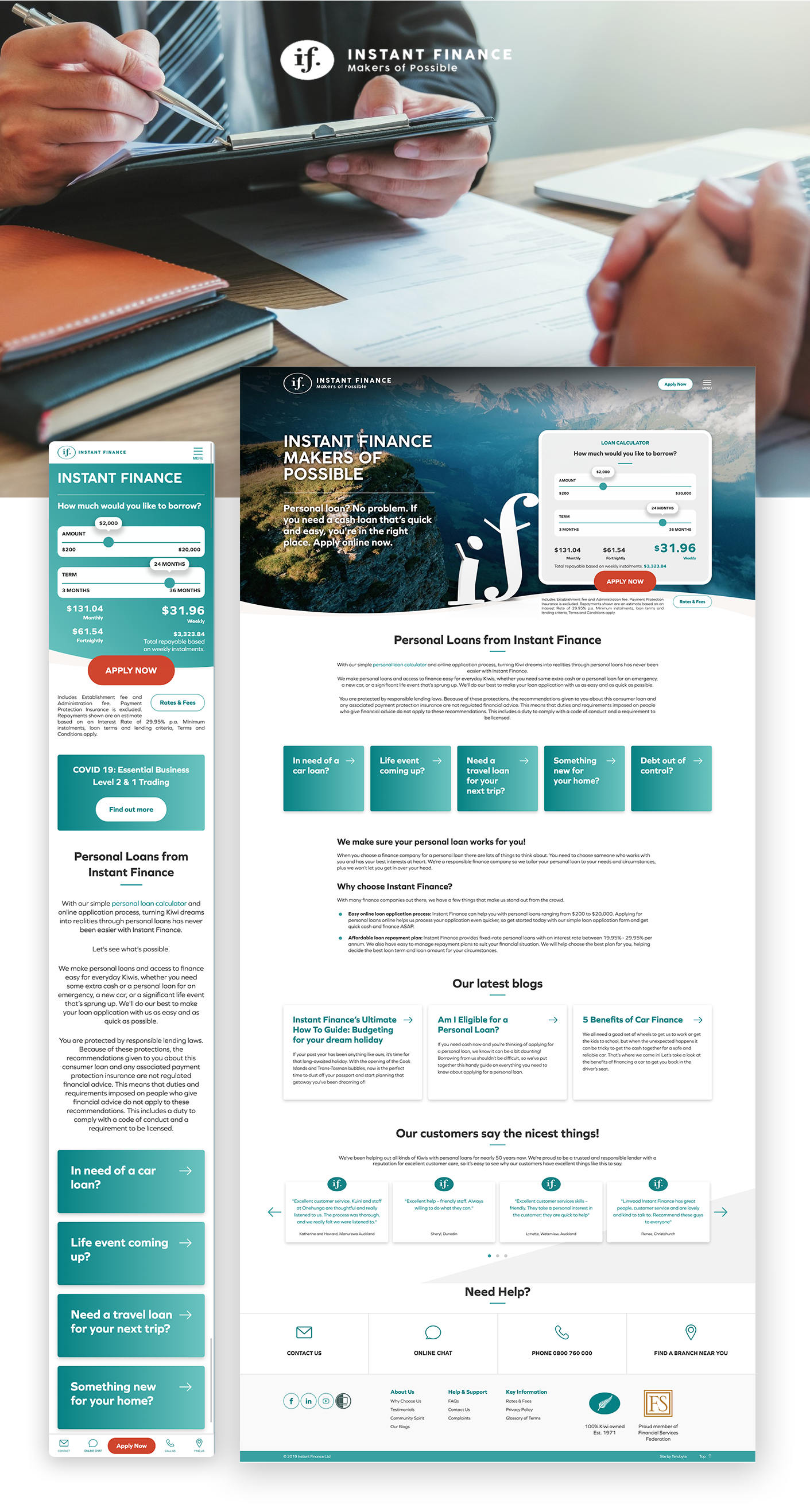

The Challenge

Instant Finance came to us not just for a new website, but for a complete digital transformation! Traditionally they were paper-based, needing customers to visit a branch and fill out a form to begin their personal loan journey. But times are changing, and Instant Finance was ready to change too.